When it comes to investing, it’s important to remember the long-term trend. Investors who focus too much on the short-term can be caught off guard when long-term trends take shape. Bonds serve as a great illustration of this point, and they serve as an invaluable component to any successful investment portfolio.

Bonds provide investors with reliable, low-risk earning potential. They can be sold before maturity for a profit or held until maturity and guaranteed a return. Bonds typically pay interest twice a year and the amount of these payments is fixed.

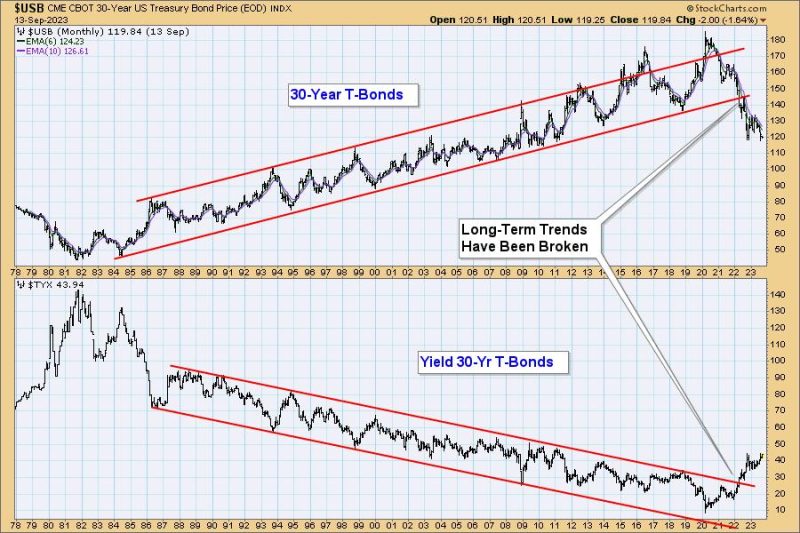

Like stocks, bonds prices go up and down over time. While fluctuations in bond prices may seem much less dramatic than those experienced in the stock market, long-term trends can still have a major impact on investment performance. Long-term bond prices tend to follow the path of rising and falling interest rates. When interest rates fall, bond prices may rise; likewise, when interest rates rise, bond prices may decline.

It’s also important to remember that bond prices are inverse to yield – the lower the interest rate that an investor requires on a bond, the higher the price. Investors should use the current very low interest rate environment to their advantage and lock in rates now on longer-term bonds. This will allow them to profit from the higher premium they can buy when interest rates eventually rise.

Investors who are looking to establish a solid bond portfolio should include a mix of different maturities. Short-term bonds are a great way to take advantage of today’s low interest rates without locking in those rates for too long. On the other hand, medium-term bonds can assist with building a portfolio’s dividend yield. Lastly, long-term bonds provide a greater resolution to interest rate fluctuations and allow investors to benefit from rising rates when they eventually occur.

For investors, it pays to take a longer-term perspective when it comes to bonds. Sure, the short-term picture can often be attractive but failing to recognize the trend of the long-term market can lead to an unexpected surprise. With bonds, the key is not to forget the long-term trend.