Welcome to Weird Wednesdays for Put/Call Ratio, your weekly update on all things stranger than fiction.

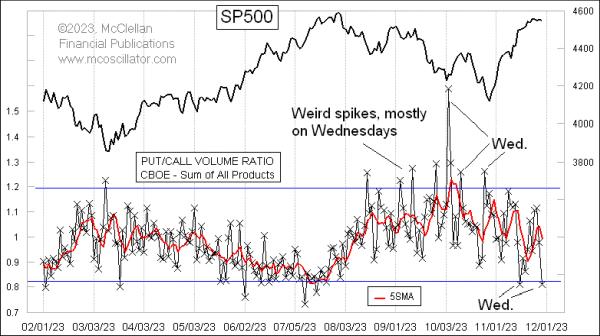

Put/Call Ratio is an important indicator of market sentiment and investor psychology. It measures the ratio of puts to calls traded on a particular security, index, or asset class. When puts are traded more than calls, it suggests that investors may be bearish on the underlying security or asset. On the other hand, when calls are traded more than puts, it suggests that investors may be bullish.

Put/Call Ratio can provide useful insights that aren’t available from other market indicators. It’s often used as a contrarian indicator, as markets can become too optimistic or too pessimistic, which can provide buying and selling opportunities. For example, if the Put/Call Ratio surges to an unusually high level, it could signal that investors have become too pessimistic and present a buying opportunity. Similarly, if the Put/Call Ratio plummets to an unusually low level, it could signal that investors have become too optimistic and present a selling opportunity.

On this week’s Weird Wednesdays, we’ll take a look at the Put/Call Ratio for several of the markets. We’ll compare the ratios to past levels and discuss what they mean for investors.

First up is the U.S. equity market. The Put/Call Ratio for the S&P 500 has been hovering around 0.5 in recent weeks. This is lower than the 0.7 figure seen in May of this year, suggesting that investors are becoming more optimistic.

Next up is the commodity market. The Put/Call Ratio for gold has climbed past the 1.2 mark, which is higher than the 1.0 figure seen in April of this year. This suggests that investors are becoming more bearish on the precious metal.

Finally, we’ll take a look at the cryptocurrency market. The Put/Call Ratio for Bitcoin has been hovering around 0.7 in recent weeks. This is slightly lower than the 1.0 figure seen in February, but still suggests that investors are becoming cautiously optimistic.

Weird Wednesdays’ Market Summary: The Put/Call Ratio can provide a useful insight into investor sentiment and market psychology. It suggests that investors have become more optimistic on the U.S. equity market, while they have become more bearish on the commodity market. In the cryptocurrency market, investors remain mostly optimistic.