PART I: UNDERSTANDING SECULAR MARKETS

In the financial realm, the concept of secular markets is one that is widely discussed yet misinterpreted most often. Stripped down to their core, secular markets refer to long-term trends that lead to consistent financial behaviors over an extended period, typically lasting for decades. They represent economic periods of consistent expansion or decline of the market.

The two main types of secular markets are the secular bull market and the secular bear market. The former is a prolonged period where the markets generally rise, with brief and mild setbacks. Conversely, the secular bear market represents an extended duration of declining trends despite occasional short-lived rallies.

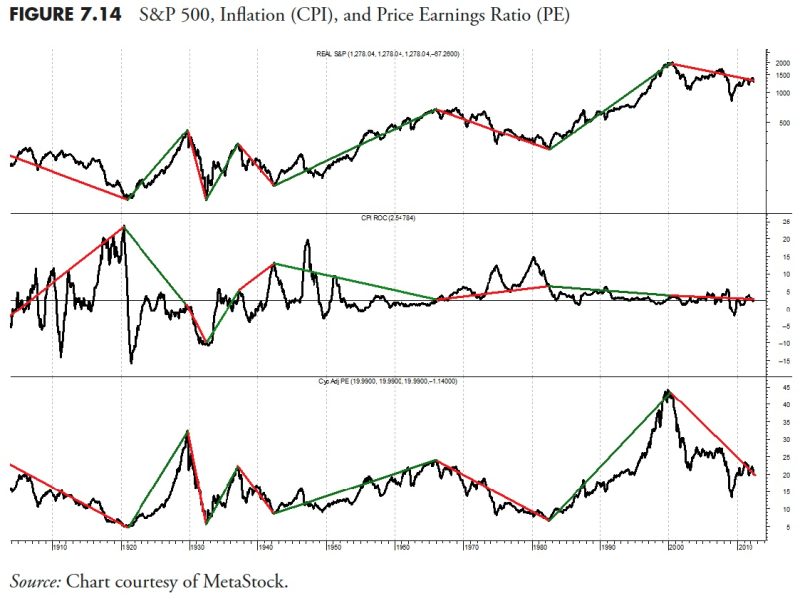

The nature of secular markets lies in the fact that they are driven by economic and market fundamentals. These include macroeconomic factors like inflation, interest rates, consumer confidence plus industry-specific parameters like supply and demand dynamics.

PART II: HOAX ASSOCIATED WITH SECULAR MARKETS

The hoax in modern finance associated with secular markets largely lies in the assumptions and interpretations made about these markets. For instance, investors often mistakenly think that secular bear markets reflect a disastrous era for investments. This impression can lead to panicked behaviors, including rapid selling or avoiding the market, which can potentially lead to losses or missed opportunities.

The truth, however, stands that even in a bear market, savvy investors can make gains by capitalize on short term rallies or even retracing patterns. The same applies in a bull market where consistent profits are not always assured as mild setbacks and occasional downtrends may sweep away gains if not properly hedged or navigated.

Another significant hoax is the reliance on historical information to predict future behaviors. In theory, one could look at the past patterns of secular markets and try to estimate future trends. However, this premise is highly flawed as the drivers of markets are constantly evolving, rending historical data, however consistent, often irrelevant.

PART III: DEMYSTIFYING THE HOAX

Shattering the misconceptions and fallacies associated with secular markets begins with fostering accurate knowledge. Investors need to understand that markets are dynamic and the economic environment ever-changing. Thus, a rigid approach that only focuses on the conventional wisdom of market trends can be detrimental.

Moreover, adopting effective market strategies like diversification and adopting cost-averaging tactics regardless of the market phase can help mitigate risks associated with market volatility. Investors should also endeavor to remove emotions from their decisions, focusing more on facts, figures, and objective analyses.

Finally, and most crucially, investors need to understand that each market phase, either bullish or bearish, does not last indefinitely. Being patient and strategic in making long-term investment decisions, rather than being swayed by market myths and misconceptions, can yield better financial outcomes.

In summary, the hoax about secular markets is partly resultant from the misunderstanding and hasty interpretations of market trends. As financial literacy improves and with the right perspective, investors can better navigate these market trends, revealing their true nature as opportunities rather than threats. Thus, exposing the ‘hoax’ of secular markets in modern finance.