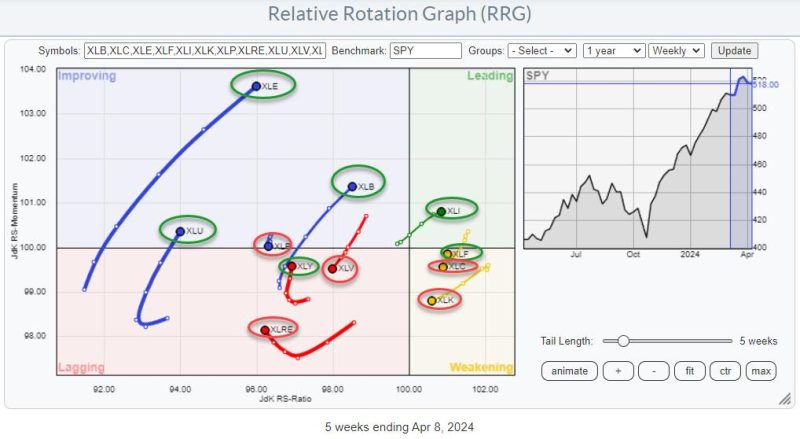

RRG, Relative Rotation Graphs, is an extremely insightful tool for portfolio managers, brokers, and financial analysts. It provides an effective methodology for understanding the relative strength and dynamism of individual securities within a designated portfolio. Recent activity on the RRG shows a significant trend that non-Mega cap technology stocks are demonstrating significant performance improvements.

Non-Mega cap technology stocks typically represent the smaller scale companies within the technology sector. These companies have a market capitalization generally less than $200 billion, which also includes small-cap, mid-cap, and large-cap stocks. They do not fall into the category of mega cap stocks which are known for their superior market capacity, such as Apple, Microsoft, and Amazon.

Although many investors might understandably be attracted towards Mega Cap Technology for their known reliability and market dominance, recent observations from the Relative Rotation Graphs indicate that Non-Mega Cap Technology stocks are demonstrating a significant upturn in their performance, showing a considerable growth potential.

Looking deeper into the RRG, it becomes clear that a disparate range of non-Mega cap tech stocks are moving from the weakening quadrant and into the improving quadrant – a signal that their momentum is growing stronger relative to other stocks. This momentum shift suggests that non-Mega cap stocks are not just leading in terms of their individual performance, but also in terms of the potential they offer for a balanced and diversified investment portfolio.

Notable among these stocks are those associated with innovative tech sub-sectors such as Artificial Intelligence, Cloud Computing, and Cybersecurity. These are areas of technology that have shown themselves to be both resilient and innovative in the face of recent global challenges, including the ongoing effects of the COVID-19 pandemic.

This upward trend of non-Mega cap tech stock performance on the RRG could be attributed to multiple factors. The first of these is the accelerated demand for digital services post-pandemic, creating an environment ripe for tech companies to thrive in, regardless of their size. Another crucial factor is the attitude of investors, who are showing a growing appetite for risk. This is especially observed in the tech sector, with these smaller tech companies offering a fresh appeal when compared to their more prominent counterparts.

However, while this upward trajectory is indeed promising, it is essential for investors to stay vigilant. The Relative Rotation Graphs represent a dynamic marketplace that demands careful monitoring. For example, while these non-Mega cap tech stocks are currently shifting into the improving quadrant on the RRG, it does not guarantee that they will continue moving into the leading quadrant.

The shift in the RRG showcases the emerging potential and resilience of non-Mega cap tech stocks, piquing investors’ interest as they carefully review their business models, strategies, and future scalability.

To summarize, while Mega Cap companies typically lure investors with their steady performance and perceived stability, the RRG is indicating a shift in momentum towards non-Mega Cap tech stocks. These smaller tech companies are showing potential for considerable growth, making them a meaningful opportunity for diversification and potential return. However, investors should not interpret this as a guarantee of success but rather a reminder of the dynamic and constantly shifting nature of the stock market.