In the world of financial markets, ‘risk’ is an entity that simultaneously incites fear and beckons opportunity. Currently, under the global investment panorama, there seems to be a projected 10% downside risk for stocks as value takes the lead.

1. Context for the Downside Risk:

The current economic environment is marked by fluctuations and uncertainties due to a myriad of reasons such as the ongoing global pandemic, geopolitical changes, and technological disruptions. This has led to significant volatility in the global stock markets. Analysts anticipate an approximate 10% downside risk, meaning there is a possibility prices might reduce by 10%.

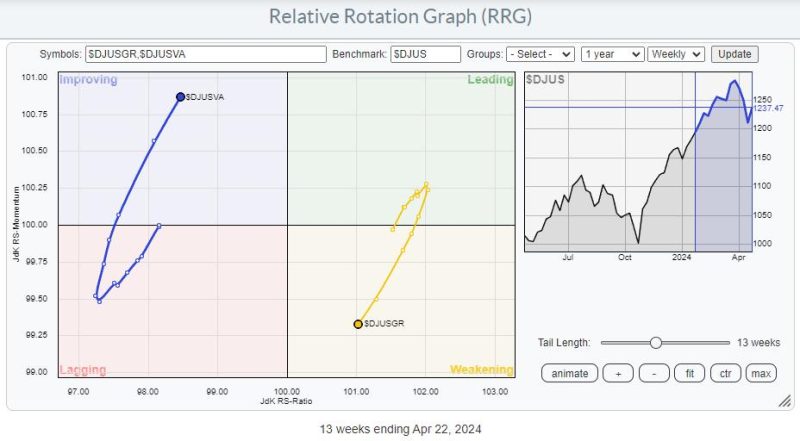

2. Value Investing Ascending:

Predictions suggest that we are in the stage of a potential shift, where value stocks may outperform growth stocks. Value stocks are shares of a company priced lower than their intrinsic values. They are often firms with solid fundamentals—like high dividend yield, low P/E ratio, etc.—but they are overlooked by investors for various reasons. As these stocks are undervalued, they provide investors with a margin of safety and higher possibilities of returns, leading to them taking the lead in the market.

3. Long-Term Sustainability:

Despite the potential for a 10% downside risk in stocks, the shift towards value stocks might often indicate a more sustainable financial terrain, in the long run. The companies facing downside risks could be overvalued. As investors start to realize this, the prices come back down, marking a correction in the market. Although this causes short-term losses, it fosters long-term sustainability as it brings stock prices in line with their real values.

4. Evolving Investor Behavior:

Investor behavior is also changing in the wake of these anticipated risks. Increasing numbers of market participants are ushering towards a cautious approach. They are looking towards value investments that promise healthy financial status and potent dividends over speculative growth stocks, which may suffer from overvaluation and subsequently, heightened downside risks.

5. Defensive Strategies:

To mitigate the 10% downside risk, investors can adopt various defensive strategies. Diversification remains a classic move to spread the risk across different sectors. Others might rebalance their portfolios, opting for value stocks over growth ones, or turn to short-selling strategies.

6. Impact on Global Financial Landscape:

This projected downside risk entails implications beyond the stock portfolios. It could impact investor confidence, international trade, economics, and ultimately, the onward direction of the world economy. Therefore, the importance of effective risk management is greater than ever in these tumultuous times.

7. Embracing Change:

In conclusion, a 10% downside risk for stocks is anticipated. While this prediction might seem concerning, it is also an opportunity for change — a change in the financial landscape and an evolution in investor behavior. As value investing takes the lead, market participants need to adjust their strategies to maintain resilience against the potential turbulence. An adaptive investment community, after all, is the backbone of a thriving financial market.