Part 1: Importance of Relative Strength

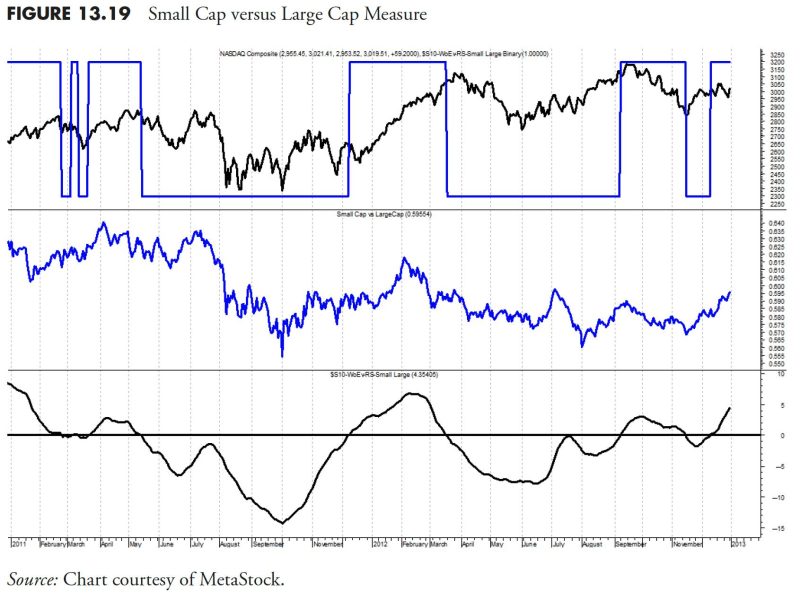

Relative Strength is often an underrated and overlooked aspect of rules-based money management. As an investment metric, it helps investors compare the performance of a stock or another investment vehicle to that of a benchmark index, such as the S&P 500. The aim is to identify investments that are outperforming or underperforming the market.

This simple comparison tool allows investors to gauge the momentum of particular stocks, sectors, or entire economies. For instance, if a stock has a relative strength higher than 1, it means it’s outperforming the benchmark index. Conversely, a figure less than 1 indicates it’s failing to keep pace with the index. Hence, relative strength can act as a significant determinant in solidifying an investor’s decision-making process.

Part 2: Using Relative Strength Methodology in Managing Funds

Advocates of the rules-based investing approach leverage this methodology in numerous ways. For instance, applying money management rules based on relative strength can refocus investments toward more robust and dominant players in the market.

One of the practical implications is the chase for winning stocks. These are equities that consistently outperform other stocks. Rebalancing a portfolio to focus more on these high performers can potentially lead to better returns. However, proper and continued monitoring is essential since past performance isn’t a guarantee of future results.

Combining relative strength analysis with market timing strategies can also lead to fruitful outcomes. Market timing involves making trade decisions based on predictions of future market trends. By coupling this with knowledge of which stocks are outperforming others, investors can anticipate market turnarounds more accurately.

Part 3: Other Pertinent Measures in Rules-Based Money Management

Aside from Relative Strength, several other measures offer value in a rules-based investing approach. The Sharpe Ratio, for instance, gauges the performance of an investment compared to a risk-free asset, after adjusting for its risk. A higher Sharpe Ratio means that the investment has either higher returns for a given level of risk or lower risk for the same amount of returns.

Another potential indicator worth using is Beta, a measure of systematic risk used in the Capital Asset Pricing Model (CAPM). It gives indications on the amount of risk an investment will add to a portfolio that looks like the market. If Beta is greater than 1, the investment is higher risk than the market; if smaller than 1, the investment is seen as less risky than the market.

Lastly, the use of Moving Averages in rules-based investing can provide insights into price trends. These can help to identify whether it is a good time to buy or sell a particular stock and assess momentum and trend strength.

In essence, Relative Strength and other investment metrics are critical components of rules-based money management. By enlightened usage of these measures, an investor can fine-tune strategies, manage risk wisely, and ultimately aim for improved investment returns.