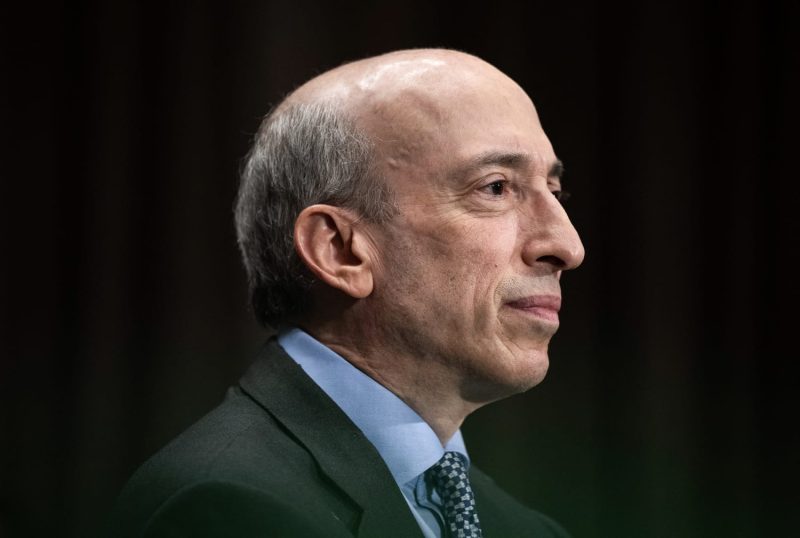

The landscape of United States financial regulation may soon experience significant shifts as news emerges that Securities and Exchange Commission (SEC) Chair Gary Gensler is set to step down from his role on January 20th. Notably, this period marks the end of an era draped with aggressive regulatory measures to boost investor confidence and streamline the already complex financial systems.

A seasoned academic and public servant, Gensler has been renowned for a progressive vision that sought to maintain a fair, orderly, and efficient marketplace. His departure paves the way for a replacement appointed by former President Donald Trump, which significantly creates room for speculation as the Trump administration holds a significantly contrasting view to current progressive policies.

Under Gensler’s tenure, significant reforms within the SEC were initiated with the aim to promote transparency, resilience, and integrity within the financial market. A primary focus was extended towards digital assets and cryptocurrencies, which he viewed as catalysts for change in financial systems. Given the rising importance and growing concerns around this sector, Gensler’s progressive approach was viewed as necessary for consumer protection and to mitigate associated risks. His stance on the platform economy also indicated his commitment to investors, advocating for clear rules that ensure platform companies are held to the same standards as other corporations.

Furthermore, Gensler’s period at the helm of the SEC witnessed a robust approach towards Environmental, Social, and Governance (ESG) issues. Following global trends, he sought to ensure that companies made adequate disclosures regarding ESG-related factors, in a bid to attract socially conscious investments. Such measures signal Gensler’s willingness to solidify a more comprehensive approach towards financial regulation, encompassing societal concerns along with the robust financial systems.

However, Gensler’s departure ushers in an era of change as Trump’s replacement takes the reins. Trump’s economic policies were largely characterised by deregulation and saw significant rollbacks in regulatory measures designed to check corporations, all in favor of promoting economic growth. His administration often overlooked stricter regulatory measures in financial markets, assuming such curbs could potentially deter investment inflows.

Therefore, the arrival of a Trump-appointed successor could potentially rewrite regulatory rules. Given Trump’s historical stance on deregulation, this could affect not only the SEC’s approach to cryptocurrencies and digital assets but also the perception and handling of ESG concerns.

Such a shift no doubt will have implications for the regulatory landscape, and by extension, the markets. As such, it’s crucial for investors, issuers, and other stakeholders to be prepared for this change and proactively engage with the anticipated revisions to the regulatory landscape.

Although Gensler’s departure may cause unease among some, it is evident that the financial regulation sector is poised for changes. As market participants, stakeholders, and observers watch with bated breath, everyone stands to see how the SEC will adapt to these developments under the leadership of the new chair. The new changes could take a completely different tangent from Gensler’s approach, making this a dynamic period for the SEC and the wider financial nuances.