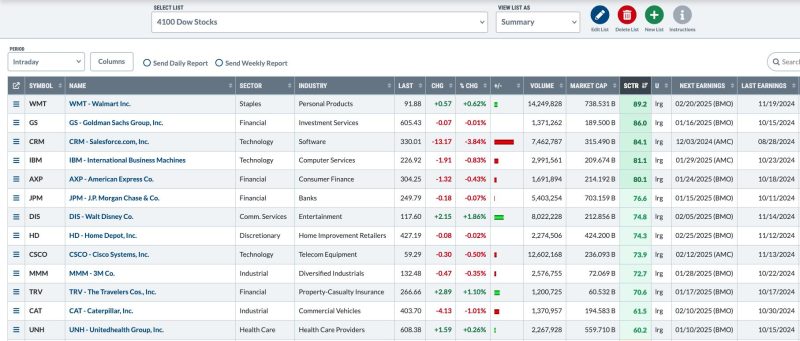

1. Portfolio Management and Sector Tracking: One of the most effective ways to utilize ChartLists is for portfolio management. By entering your different investments into separate ChartLists, you can track the performance of individual stocks, mutual funds, ETFs, or other securities neatly and effortlessly. This practice not only facilitates easy evaluation of portfolio performance, but it also helps to identify top-performing or under-performing holdings in real-time. Besides, ChartLists can also serve as a brilliant tool for tracking different sectors. By constructing distinct ChartLists for sectors such as technology, healthcare, energy, etc., you can visually track the overall market’s performance.

2. Technical Analysis for Trading Strategies: Traders, especially ones who rely heavily on technical analysis to guide their trading decisions, can benefit immensely from ChartLists. You can utilize ChartLists to create a detailed roadmap of your potential trades by precisely annotating significant price levels, trendlines, and patterns. This preparation helps traders to pinpoint entries and exits and to see visually how these potential trades fit into broader market trends. With ChartLists, you can also track different technical analysis indicators and signals for each stock, thus fostering more educated trading decisions.

3. Swing and Day Trading Watch Lists: For those interested in more short-term trading, such as swing or day trading, ChartLists could be your secret weapon. Using ChartLists, you can curate a list of stocks with the trade setups you’re interested in and update it as market conditions change. This way, you can maintain a perennial pool of potential trading opportunities at your fingertips. WatchLists also save valuable time by eliminating the need to run through the same stocks repeatedly and help to ensure you don’t miss out on trade opportunities as they emerge.

4. Backtesting and Trading System Validation: ChartLists can be used in conjunction with technical scanning and back-testing tools to validate personal trading systems. By incorporating stocks from specific sectors, industries, or asset classes into a ChartList, you can backtest your trading strategies under various market conditions and scenarios. This not only helps to evaluate the effectiveness of your trading system in different market environments, but it also aids in identifying any potential weaknesses, thus helping improve your overall trading methodology.

5. Long-Term Market Trend Analysis: Lastly, ChartLists serve as an excellent tool for long-term market analysis. By setting up lists of fundamental economic indicators like GDP growth, inflation rates, employment data, or other metrics of interest, you can visually track and analyze these indicators over long time spans. This can help identify significant macroeconomic trends and could potentially forecast market turning points.

Embracing the versatility of ChartLists as a portfolio management tool, a technical analysis tool, a day trading tool, a backtesting tool, and a long-term market analysis tool, can help both novice and experienced traders improve their market understanding, strategy formulation, and trading outcomes. Happy charting!