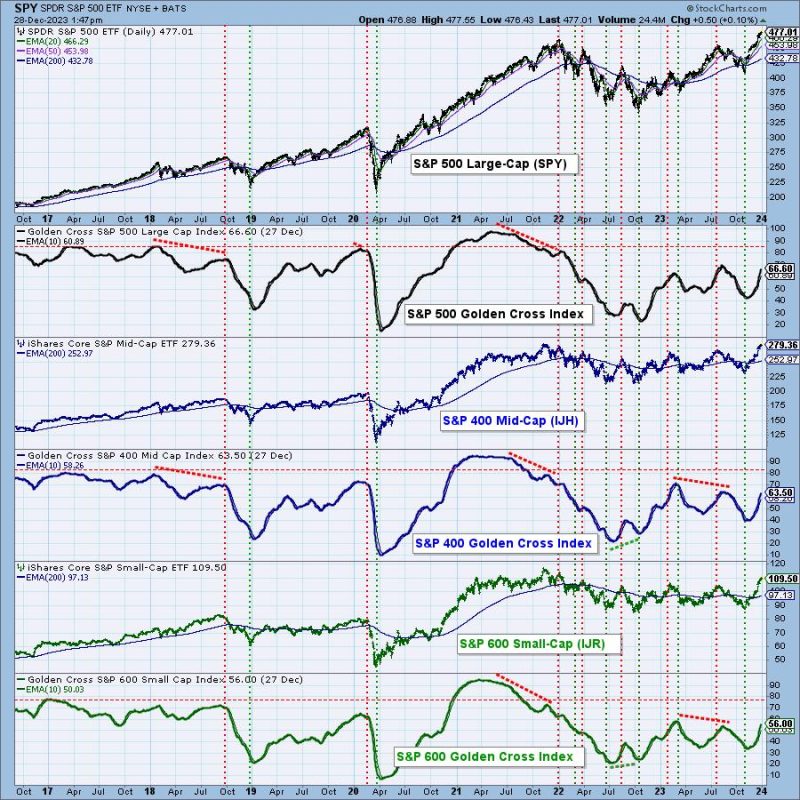

With markets reaching historic highs, one area of concern among investors is the sustainability of recent market performance. While market sentiment has been growing positive in recent weeks, there is still reason for caution. Intermediate-term participation levels are very overbought, and they are weak long-term.

A recent look at the S&P 500 using 10 and 21 day moving averages to measure participation levels, shows both of these time frames are highly overbought. From a technical analysis perspective, this is an indication of short-term market exhaustion and suggests that the market may soon move lower.

The long-term perspective is even more concerning. Market participants are still hesitant about committing to long-term positions in stocks. The lack of long-term investors suggests that the market is vulnerable to a major selloff when trading dynamics change.

Another indicator of market health is the relationship between stocks and bonds. Currently, yields on US long-term bonds are much lower than yields on US stocks. This is a sign that investors may be more concerned about the risks in stocks than in bonds.

Finally, the strength of the US dollar is also a worry. Since April, the US dollar has strengthened, which means that American investment capital has been flowing out of the country. This could weigh on risk assets if the dollar remains strong.

Overall, market sentiment is still positive, but investors need to be cautious. Intermediate-term participation levels are very overbought and they are weak long-term. This indicates that a short-term market pullback could be coming, and if the economy experiences a slowdown, the market could be headed for a sharp sell-off.