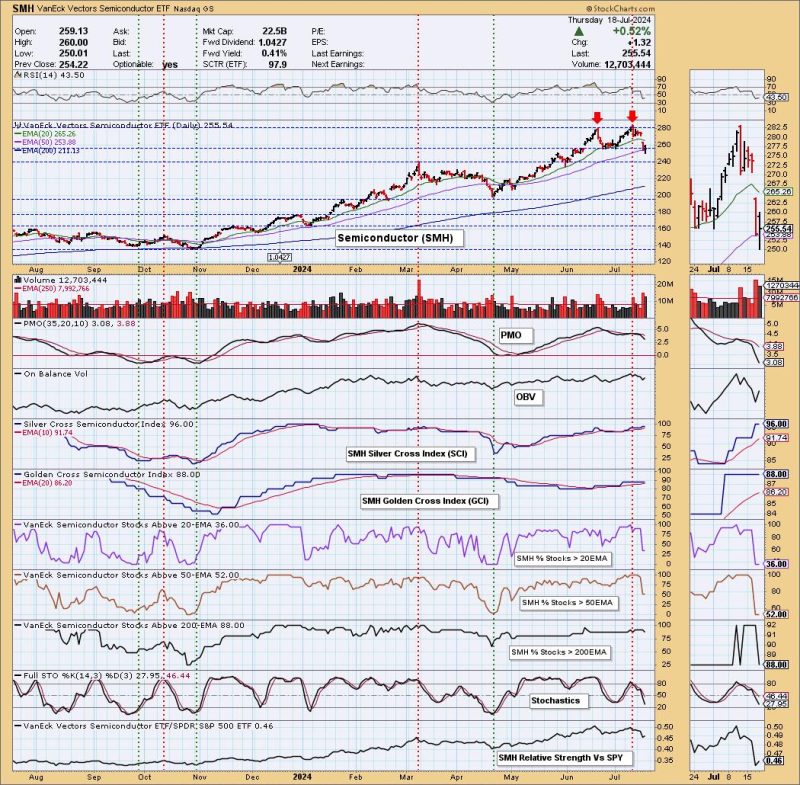

As we delve into the intricacies of double top patterns on semiconductors (SMH), it is important to define exactly what is meant by a double top. This is a bearish reversal chart pattern that signals a potential change in the direction of the trend, from bullish to bearish. In technical analysis, this pattern is considered one of the most reliable indicators, and for those studying the semiconductors (SMH), it can provide deep insights into market trends.

A double top pattern on semiconductors often occurs after an uptrend and is characterized by two consecutive peaks approximately on the same level. That is, the price of the security rises to a particular level, retreats, then rises back to the same level before falling again. The double peak resembles the formation of a ‘M’, presenting a clear visual signal of the imminent trend reversal in SMH.

Interpretation and significance of the double top in semiconductors involves keeping a keen eye on volume. Typically, volume will follow the price, being heavier during the rise to the first top and lighter during the formation of the second. When the semiconductor security price falls below the ‘valley’ or ‘neckline’ created after the first peak, this suggests a bearish reversal in the market trend. This break in the neckline with a significant spike in volume often confirms the double top pattern.

While the double top is a bearish pattern, it can also offer potential buying opportunities. Traders often wait for the price of the SMH to drop below the neckline, then retest it. If the price fails to move above the neckline (resistance level), it often provides traders with an opportunity to short sell the SMH, banking on the price to go lower. However, if the price moves above the neckline, it negates the pattern, and traders may decide to buy with hopes that the price will continue to rise.

For investors in the semiconductor sector, using the double top pattern can be of strategic use. This pattern provides crucial hints on when to enter or exit a trade based on the market trends and reversals it indicates. Specifically for semiconductors, where an industry’s technology adoption lifecycle can be rapid and highly disruptive, recognizing the double top pattern in the price of SMH can help investors to maximize gains and minimize possible losses.

Furthermore, the double top pattern’s reliability can be enhanced when used in conjunction with other technical indicators, such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Bollinger bands. RSI, for example, helps in identifying overbought or oversold conditions in the market. If RSI readings coincide with the formation of the double top and indicate an overbought condition, it offers additional confirmation for the bearish reversal pattern.

An important caveat to remember when identifying a double top in semiconductors is that it’s human nature to see patterns where none exist – a phenomenon called apophenia. Therefore, it is crucial to not perceive every double peak as a bearish signal. Smart investors will meticulously validate their interpretations with other technical indicators and consider market context before making a decision.

In conclusion, the double top pattern in semiconductors is a crucial technical indicator that can greatly aid in understanding market trends and making informed investment decisions. Even though it signals a dramatic transition point, it also deciphers potential opportunities for savvy traders who understand its nuances to strategize their buying and selling decisions, making effective use of the underlying market volatility to their advantage.