The Body:

The economic indicators have recently flagged off a déjà vu in the consumer staples sector that is reminiscent of volatile market conditions. The sudden changes in the stock market patterns have prompted investors and market observers to a familiar yet unsettling recognition of past events – something akin to a financial déjà vu. This noticeable parallel suggests that the current market dynamics could be a smoke signal warning of significant turbulence ahead.

The consumer staples sector, which comprises businesses that sell essential, non-cyclical products such as beverages, food, and household goods, usually thrives irrespective of the economy’s health. Their stock prices generally exhibit steady growth trends since these companies see constant demand regardless of economic conditions due to the nature of their products. However, the recent market developments have threatened to disrupt their reputation for stability.

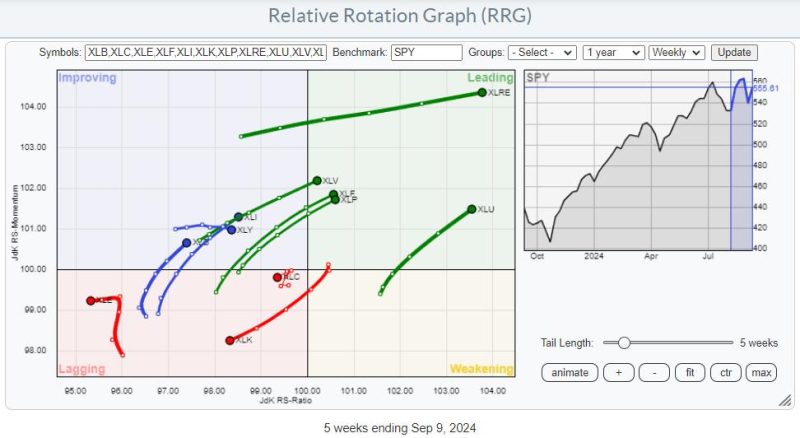

Examining these peculiar patterns, one might recall similar instances from the past where the sector’s relative outperformance predated significant market corrections. It seems history is repeating itself with the consumer staples sector performing better than its counterparts – a trend usually seen when investors shift to defensive stocks amidst uncertainty. This migration to perceived safer assets typically happens when investors predict a downturn. It is this shift that hints at the potential of an economic storm brewing on the horizon.

One striking parallel researchers have drawn is with the period leading up to the financial crisis of 2007-2008. During the twelve months leading up to it, there was a pronounced flight towards safety, with the consumer staples sector notably outperforming the rest of the market. Ignoring the signal at that time proved disastrous for many investors; the subsequent crash wiped billions off the stock market, causing widespread panic. The financial déjà vu we are currently experiencing points to similar underlying issues, sending a strong warning signal that should not be disregarded.

Complementing the warning signal from the consumer staples sector, other economic indicators also raise red flags. They suggest slowing growth, expanding fiscal deficits, and escalating trade tensions – all factors that were present during earlier periods of financial crisis. It is crucial to note, though, that these indicators are not merely harbingers of doom. They offer the potential for proactive decision-making and strategic adjustments that could shield investors from impending shocks.

Efforts to analyze these signals involve monitoring key metrics like dividend yields and volatility measures, alongside more intricate assessments like the price-to-earnings ratio. Keeping a close eye on these indicators could provide valuable insight into what lies ahead. By understanding the patterns at play, investors can position themselves wisely, potentially leveraging volatility for gain while guarding against pitfalls.

In response to the ostensible déjà vu, some have advocated for a cautious approach, suggesting investors might pull back from riskier investments and redirect funds into secure assets. Others have argued for increased diversification, advocating a spread across different sectors. Meanwhile, some have proposed a blended approach, combining defensive strategies with calculated risk-taking to navigate the trickier market seas.

While the consumer staples sector’s sudden outperformance might be viewed as a warning signal, it doesn’t necessarily seal the fate of the global economy in a traumatic financial chapter. We must remember that markets function in cycles, with ebbs and flows, ups and downs. As such, a déjà vu essentially helps to caution against possible missteps rather than predict a certain catastrophe.

To conclude, this financial déjà vu in the consumer staples sector serves a vital warning function. It emphasizes the need for vigilance, resilience, and adaptability in managing investments and navigating the financial markets. Recognizing the warning signals of a potential financial downturn can help market participants prepare and strategize to endure the possible repercussions, thereby fostering a more resilient economy.